philadelphia wage tax for non residents

We ensure that the Philadelphia Water Department has the financial resources needed to provide reliable high-quality water to Philadelphia residents businesses and communities. The value of non-residential parcels like commercial properties which took a hit during the coronavirus pandemic increased only 9 on average.

Tax Breaks As Property Values Surge Tourism Makes A Return Septa Starts Cleanup Blitz Sunday Roundup On Top Of Philly News

Philadelphia has a 3924 wage tax on residents and a 3495 tax on non-residents for wages earned in the city as of August 2013.

. Philadelphia wage tax credits may not be applied to your spouses liability. The most common situation for filing and paying the Earnings Tax is when a Philadelphia resident works for an out-of-state employer. In the first citywide reassessment in three years the value of the average residential property in Philadelphia increased a staggering 31 Mayor Jim Kenneys administration announced Tuesday.

This tax known popularly as the mobility tax or the MTA tax is intended to provide funds for the Metropolitan Transportation Authority which transports many of the regions commuters. Philadelphia resident with taxable income who doesnt have the City Wage Tax withheld from your paycheck. Please be advised that per a court decision passed down on 1713 individuals who have City of Philadelphia Non-resident wage tax withheld may apply the taxes paid as.

For non-residents the wage tax would. The Department of Revenue also administers the Citys many tax and assistance programs. In 2021 city residents made up 685 of the wage tax revenue as workers who lived outside of Philadelphia and worked remotely during the pandemic were largely exempt from non-resident city wage.

A non-resident who works in Philadelphia and doesnt have the City Wage Tax withheld from your paycheck. For Philadelphia residents the wage tax would drop to 37 from its current rate of 38398.

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

Philadelphia City Council Unveils 5b Budget Whyy

Wealth Tax Proposed In Philadelphia With Support From Sen Elizabeth Warren Philadelphia Business Journal

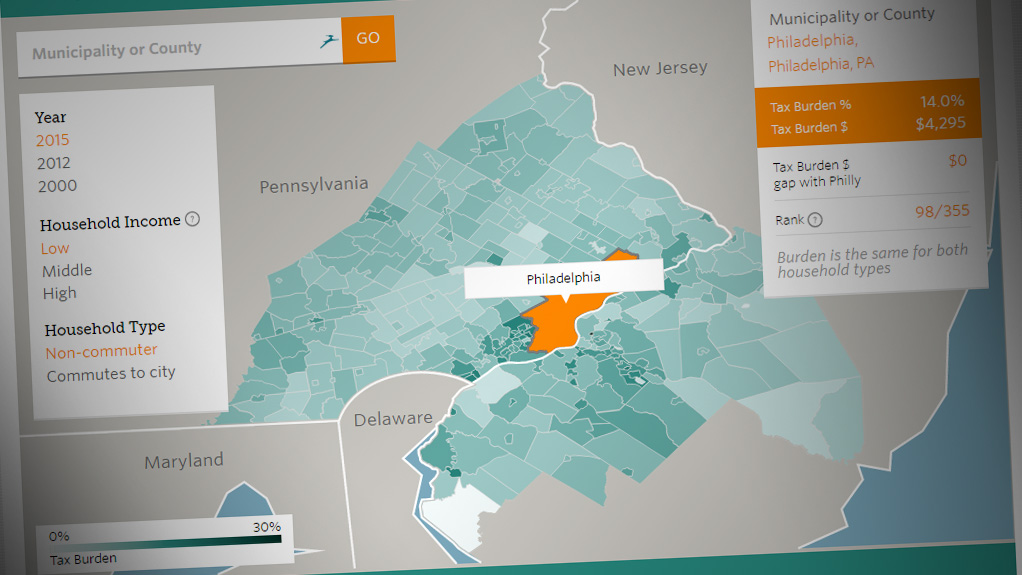

Comparing The Tax Burden In Philadelphia And The Suburbs The Pew Charitable Trusts

2020 Philadelphia Tax Rates Due Dates And Filing Tips

Philadelphia Wage Tax Decreases On July 1 Department Of Revenue City Of Philadelphia

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Pennsylvania Rules On Philly Wage Tax Credit Case Grant Thornton

When Are Non Residents Exempt From Philadelphia S Wage Tax Department Of Revenue City Of Philadelphia

Philly Wage Tax To Be Lowered In New City Proposal Whyy

Over 42 000 Philadelphians Use New Online Tax System On Top Of Philly News

Philly Wage Tax To Be Lowered In New City Proposal Whyy

Who Is Entitled To A Wage Tax Refund Department Of Revenue City Of Philadelphia

Philadelphia Looks To Reduce City Wage Tax To Offset Rising Property Tax Burden Philadelphia Business Journal

City Of Philadelphia Announces Wage Tax Rate Increase For Non Residents Starting July 1 2020 Wouch Maloney Cpas Business Advisors